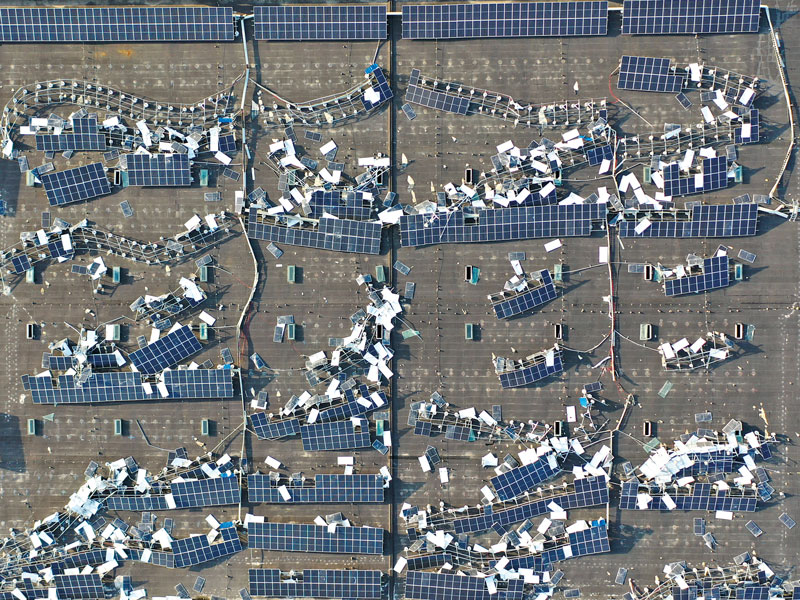

Rooftop solar panels destroyed

by the violent wind in Nantong, China

Author: Sara Ver-Bruggen, Features Writer

Solar is the fastest-growing energy source in the world. Between 2013 and 2022, 46 percent of global renewable energy investments flowed into solar photovoltaics, according to the International Renewable Energy Agency (IRENA), which also highlighted that in 2022 solar PV accounted for 60 percent of this investment, around $300bn. But as extreme weather events increase in frequency, insurers and lenders want assurances that potential threats to productivity, performance and resilience of these assets are being addressed.

Towards the end of the last decade, a large loss for a utility-scale solar PV plant would typically be in the region of $100,000 to $200,000, perhaps as much as $1m. According to specialist renewables insurer GCube (owned by Tokio Marine HCC), which has underwritten over 20GW of solar capacity, claims due to damage from hailstorms to solar PV plants in the US now average around $58.4m per claim and account for 54.21 percent of incurred costs of total solar loss claims.

GCube director of operations and legal counsel, James Papazis, says: “The premiums for the solar plant’s construction phase as well as its operational phase have increased, along with increases in deductibles and imposed sub-limits and limits.”

Today $100m-plus losses from hail damage at solar sites in the US are not unusual with sub-limits at $50m–$60m. The loss is shared by multiple insurers and reinsurers. Even then the project is exposed with an uninsured loss for a substantial figure. “This had led to tension between financiers, lenders and insurers.

As a result, more due diligence and effort is occurring at the planning stage of projects, and insurance is also being discussed at a much earlier stage of the project’s development because lenders want to know about sub-limits, premiums and deductibles,” Papazis says. As solar PV projects have increased in size and are increasingly being sited in more remote locations, longer construction phases ensue. Supply chain bottlenecks and limited availability of components and equipment have also impacted projects so they are taking longer to build.

Construction risks

“If project construction phases fall behind it can expose projects to additional risks because it may occur in wind, hail or tornado season and fully complete projects are more resilient to damage than incomplete ones,” says Papazis. According to Paul Raats, principal consultant, energy systems at risk management consultancy DNV, financiers and insurers are paying increasing attention to the risk that comes with climate change and extreme weather events. “In north-east Europe, it has led to additional risk analyses to ascertain a solar project’s viability with increased impacts in the instance of heavy rainfall and winds.”

DNV has advised IRENA on developing a set of recommendations to help the solar PV industry better manage extreme weather event-related risks regarding solar projects and assets. “More attention needs to be given to sudden harsh weather during construction as the PV systems are not at their full bearing capacity and are more vulnerable to heavy loads,” says Raats. Developers and their contractors are advised to schedule construction by considering short-term weather forecasts, a practice that is more usual in offshore wind.

$100m-plus losses from hail damage at solar sites in the US are not unusual

“In extremely wet or flood-prone regions risks can be better understood and mitigated during the development stage by carrying out detailed geotechnical, hydrological and flood risk assessments,” Raats continues. DNV also advises that assessment of 100-year flood probability should be part of these assessments and any recommendations should be considered in the project design. These can include ensuring increasing the height of mounting systems so the bottom edge of the solar PV module is above the highest historical water level, installing inverter cabinets off the ground, reinforcing foundations and adding draining systems or modifying existing drainage. Furthermore, insurance against damage should provide an additional layer of financial protection to the projects located in such regions. As well as advising that projects should have an owner’s engineer for oversight, inspectors during plant construction should be employed and contractors should have proper insurance in place, according to DNV.

Wind, rain, floods and landslides

Solar developer and asset owner Lightsource bp intends to start construction works on a 100 megawatt (MW) project in Taiwan once financial close is reached in the next two to three months. The extent and frequency of extreme weather events on the island is increasing. Higher wind speeds, more rainfall as well as flooding and accompanying landslides have to be considered. Lightsource bp’s specific mitigations for its Budai solar project include technical requirements to ensure equipment is high enough – at least 1.1 metres – to account for potential subsidence/landslides, which are determined through historical trends as well as considerations like flash flood events. Double glass modules to reduce the chance of water ingress will also be used instead of those with polymer backsheets.

The developer has also involved reputable international parties with strong local experience like Fitchner, as owner’s engineer, and TÜV Rheinland, as lender’s technical adviser, to check its assumptions and design. In addition, project level insurance is in place to cover force majeure events.

Weather modelling

The frequency, intensity and unpredictability of weather and its impact on solar farm yields, or productivity, as well as its potential for damaging solar assets, can be mitigated by weather monitoring and modelling.

US solar plant owners and developers are adopting approaches where they use ground weather monitoring stations – onsite sensors – at their project site for a minimum of a year. The gathered data can then be compared with high-resolution satellite data, sometimes going back 20–30 years, to produce bankable site-specific data. Solargis, which provides this kind of modelling service, counts solar PV project developers and independent power producers, as well as technical advisers and independent engineers on projects, while banks also use its data and services for their financing process.

Accurate historical temperature and irradiation values are crucial for analysing trends, predicting scenarios, and making informed decisions, says Giridaran Srinivasan, Solargis’ Americas CEO. “This allows for more accurate prediction of output, based not only on the best-case scenario but also for periods of extreme or non-typical scenarios. More and more, lenders in the solar PV sector are including rigorous due diligence procedures for project funding.” As part of this process, they require calculations and simulations that incorporate more extreme event models upfront to account for the worst-case scenario in terms of energy production. The aim is to provide an accurate representation of the solar PV project’s potential performance.

“The use of such models ensures that lenders have a comprehensive understanding of the risks involved in financing a given project so it is important for project managers and developers to incorporate these extreme models in their simulations to secure funding,” Srinivasan adds.

Technological adaptations

More accurate modelling and better data is also helping the supply chain to respond to the challenge. Solar module tracking systems are becoming more mature and mainstream with built-in intelligence models, for example.

Kevin Christy, Head of Innovation & Operational Excellence, Americas, at Lightsource bp, says: “The US is experiencing severe hail events in Texas, Kansas, Oklahoma, to name a few. A large hail stone can do a lot of damage if it hits a solar panel dead on. Our hail monitoring and mitigation system, Project Whiskyball, helps to mitigate damage.”

The trackers that the company uses in its projects tilt in order to maximise the incoming light from the sun. But when the risk of a hailstorm is detected, the trackers stow the modules in a more vertical position.“Any hail striking the modules will be reduced to a glancing blow rather than a direct hit. It is extremely effective at reducing the force applied by any hail and greatly reduces the potential for damage. Project Whiskyball is now operational across all of our completed solar assets in the US,” Christy adds.

Lenders in the solar PV sector are including rigorous due diligence procedures for project funding

Solar Defender Technologies has developed a protective net that covers modules mounted on single axis tracker systems, used in ground-mounted utility-scale installations, while allowing the modules to move to achieve optimum energy output. A combination of the increased costs of solar technology adaptation plus the tripling of insurance premiums in the last few years, is eroding the profitability of some solar plants. In some cases there may not be the coverage available to give the developer the comfort to build. Papazis says: “This is becoming a big issue for the industry. When lenders have to factor in increased premiums or uninsured hail losses, the economics of projects can change significantly. There isn’t really a clear answer yet.”

Where developers are building projects that they intend to operate and own for the majority of the operational lifetime, lenders are more comfortable with these sorts of companies to partner with. “This long-term approach does change the economics, making it attractive for those with large balance sheets and large portfolios,” adds Papazis. Portfolios with projects spread across different locations and regions mean that ones in a hail-prone part of a state or by the coast can be offset by others that are in areas where weather is less severe. The main problem with the weather has always been its unpredictability, and climate change isn’t helping.

“Wildfires are the latest issue for the industry. Generally, solar projects in some parts of the US are becoming more expensive to finance and insure due to mitigating against more weather events, not just natural catastrophe,” he says. The industry has options available to support mitigation and underwriting of risks, including paying more attention to site selection, equipment and technology choices and making better use of weather modelling, as well as looking at water tables and frequency of flooding events. “There are multiple factors so use of multiple different modelling tools, including satellite imagery, is important,” says Papazis.

#extreme #weather #events #threaten #rise #solar